By Fiona Tait, Technical Director, Intelligent Pensions

As a pensions specialist I believe the value we should be delivering should be less about interpretation and more about the overall retirement plan. This chimes with some recent work carried out by Vanguard “Assessing the Value of Advice”, which looks at what clients really value in their financial advisers.

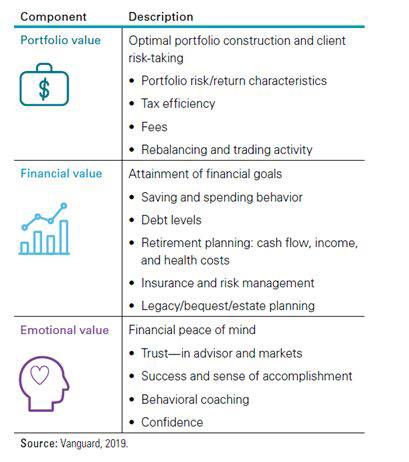

Given the fact that many advisers are remunerated by reference to fund size a lot of previous analysis has focussed on investment performance, however this is just one aspect of the advice and arguably one least relevant to the actual work carried out by most advisers. Vanguard looks beyond what they term ‘portfolio outcomes’ and considers the importance of both financial and emotional outcomes as well.

Measures of value

1. Portfolio Outcomes

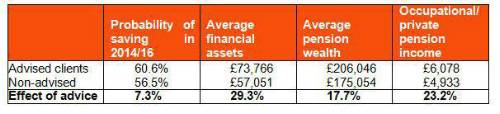

Don’t get me wrong, a professional adviser should be able to achieve better returns, on average and over the medium to long term, than most self-investors and according to the ILC they mostly do. Their report “What it’s Worth: Revisiting the Value of Financial Advice” showed that advised clients tend to be wealthier, have better pensions and (not unrelated) save more:

Source: ILC December 2019

This result is however dictated by more than selecting the right investment funds. Rather it is dependent on selecting the right type of funds and assets and persuading clients to create and stick to a strategy that is capable of delivering the returns they need. The same study showed that advised clients typically invested 29.6% of their portfolio in ‘risky assets’ in comparison with 22.1% by non-advised clients.

The Vanguard report goes a little further, finding that while overall equity content was fairly similar in both advised and non-advised individuals, the former is more likely to hold bonds than cash and deposits, and to have less of a bias towards UK based funds. This creates a more diversified portfolio capable of higher growth and greater resilience against individual market shocks.

2. Financial outcomes

Vanguard’s second measure of the value which financial advisers deliver, one which is particularly relevant to retirement planners, is the level of success in achieving the client’s individual financial goals. This encompasses helping the client to set realistic targets in the first place and then carrying out a professional analysis of the savings and investments required to get them there. Cashflow planning not only manages client expectations but it can demonstrate relative progress over time.

The Vanguard study found that as of January 2019, eight in ten of their investors with a retirement goal had an 80% or greater probability of achieving their objective, of which 76% had a 90% to 100% probability. This is what happens when you have a plan.

3. Emotional outcomes

This is the most difficult to measure, but undoubtedly one of the most important factors in the adviser client relationship. We deliver peace of mind. Vanguard’s analysis suggests that emotional outcomes account for 45% of the total perceived value of financial advice, and there is no doubt in my mind that it is this that creates the sort of client loyalty that is needed for long term planning.

This financial peace of mind needs to be based on more than just a liking for the individual involved, it includes a sense of trust, confidence in the adviser’s abilities and the support given throughout the ups and downs of their retirement journey.

Summary

The Vanguard study is admittedly based on a specific universe of individuals, and both they and the ILC sponsors - Royal London - have an interest in supporting the value of advice however, these facts and figures ring true to me. I look forward to the day when my time is spent more on understanding client goals and putting together a workable plan, rather than the joys of carry forward and tapered Annual Allowance calculations.

|