Peter Brooke, director, Navigant Financial Services

FATCA (the Foreign Account Tax Compliance Act) will soon become one of the most powerful tools the U.S. Government will have in its arsenal to combat offshore tax evasion. It will require foreign banks to report and disclose US interests in foreign financial institutions (FFIs). FATCA seeks to enforce the reporting of US- held foreign accounts by mandating 30% withholding on US source income (including gross sales proceeds), should any account holder or FFI not comply.

This comes in the wake of the past two years where UBS AG entered into a deferred position agreement and paid $780 million to the US Government for maintaining undeclared offshore accounts for US taxpayers; more than a dozen US taxpayers pleaded guilty or were charged with tax fraud for maintaining undisclosed accounts and thousands of US citizens disclosed their secret bank accounts to the Inland Revenue Service. Other countries may now follow suit by pursuing the tax gap resulting from citizens’ maintenance of previously undisclosed accounts.

The goal of FACTA seems simple and to the point: to combat offshore tax evasion. When put into practice, however, it becomes an extremely complicated process requiring coordination by personnel not only across business lines of the FFI but across the globe. Even though FFIs will not have to start reporting to the IRS until September, these complexities necessitate that the first steps of preparation should begin immediately.

For the purposes of FATCA, the definition of US accounts is very wide and financial services firms will need to search existing customer records for a wide range of ‘indicia’ of US status. This will include US addresses associated with the account, a US place of birth, and standing instructions to transfer funds to the US. A variety of operational challenges thus exist for large and smaller firms and financial institutions in order to be ready for the regulation changes.

Understanding select FATCA terms

.

According to FATCA, an FFI is a foreign entity that (1) accepts deposits in the ordinary course of a banking or similar business, (2) as a substantial portion of its business, holds financial assets for the account of others, or (3) is engaged (or holds itself as being engaged) primarily in the business of investing, reinvesting, or trading securities, partnership interests, commodities or any interest in these mentioned items.

FFIs will be required to report the following for all US Accounts to the IRS: 1) The name, address and taxpayer identification number for each individual or US owned foreign entity account holder, 2) The account number, 3) the account balance or value and 4) gross receipts and payments from the account.

Identifying all existing US customers

Many foreign governments worry that FATCA could cost their biggest banks hundreds of millions of dollars to comply with the regulations. The initial guidance from the IRS is complex and over sixty pages long, setting out the requirements that each FFI must implement.

FATCA could implicate any number of individuals and organisations including anyone deigned a US resident or citizen, anyone holding a US address such as a holiday home in Florida or anyone whose place of birth was in the US.

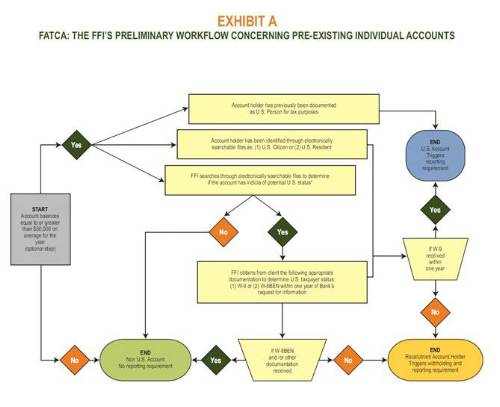

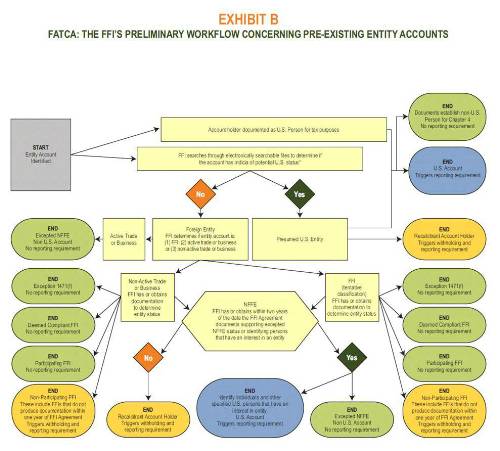

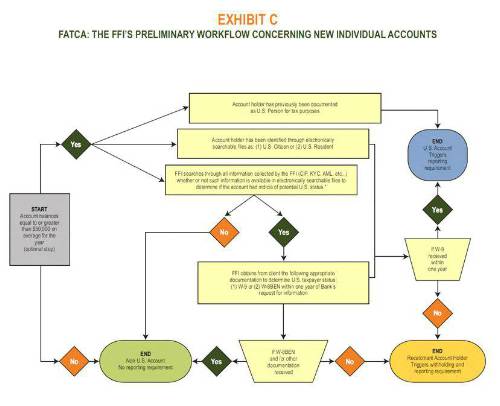

For pre-existing accounts maintained in the name of individuals or entities, the FFI is able to rely on electronically searchable information to comply (see exhibit A). Unfortunately for pre-existing accounts maintained in the name of an entity, the workflow is more substantial as there are numerous categories in which an entity can be classified (see exhibit B). For new accounts established after the FFI agreement with the IRS (the Inland Revenue Service), the process is similar to the work you would complete for a pre-existing account. The main difference being that FFIs have to use all information collected by the FFI and not just electronically searchable files (see exhibit C).

The key to building a strong FATCA compliance programme

It is important that each FFI begins to take steps to create an awareness programme, identify the information already collected by the FFI on its customers and develop and implement a program of systems, policies and procedures and corporate governance to deal with FATCA. There is no scope for a ‘blanket’ approach as each business entity of the FFI may collect different information on their customers. Early on in the process we suggest creating a task force to determine how the FFI is going to comply with FATCA. This task force must identify all stakeholders that may be affected by FATCA, particularly paying attention to FFI operations in jurisdictions with enhanced secrecy rules.

After identifying all potentially affected groups and businesses, it is important to determine what information each has regarding its client base. In addition to reviewing electronically searchable files to identify potential accounts, it is also important to document and assess client information not maintained electronically as any changes to the collection of the information of account holders will likely take a considerable amount of time to implement. FATCA compliance teams may wish to determine: for example whether there is a copy of a passport in every customer’s file (bearing in mind certain privacy laws regarding the transfer of information across borders when developing a new database or linking previously developed databases) and if all addresses associated with the account are maintained in a single system. Additionally, whether the account opening questionnaire needs to change to address the potential identification of US accounts and indicia of potential US status of the account holders including green card holders.

Capturing the right information for new customers

The account opening process may change significantly as a result of the new requirements by FATCA to provide accurate information to the IRS. FATCA task forces should think about aggregating the necessary information in one electronic system or linking different systems to decrease the number of databases that need to be searched to identify potential US accounts and report on those accounts. This could have unintended consequences on UK retail banks, for example, which would have to check if any indicators exist of a customer being subject to FATCA regulation. This may prove difficult where data privacy issues exist in certain countries.

Conclusion

Large banks have estimated they will need to spend a minimum $250 million each to contact clients and overhaul computer systems, according to the European Banking Federation and Institute of International Bankers. While FATCA does not come into effect for another two years and further guidance is due to be issued by the IRS, organizations should not delay in preparing for the significant changes that FATCA will bring. If early indications are correct, this will not be an isolated regulatory change. FFIs may well see other countries follow suit and pursue offshore accounts of their own taxpayers. Similarly it is not only FFIs and high net worth individuals who should be preparing for this change. Whilst initially the targets will be the larger institutions and high net worth individuals, smaller organizations will be next in line and should be ready for the long arm of the IRS.

To view high-res imgaes of the above diagrams please download the PDF.

|