Children born today are likely to face financial headwinds that were not experienced by their parents and grandparents. Their university fees may need to be paid for personally, the deposit for their first home is likely to be more difficult to find, and the pensions provided by their employers are likely to be less generous than those provided to their parents. Many parents or grandparents should therefore consider ways that they can help their children financially.

Bob Fraser, senior client partner, Towry:

“All individuals under the age of 75 are able to invest up to a maximum of £2,880 per year (net) into a pension and benefit from a 25 per cent tax uplift, irrespective of whether they have any earned income. The result is £3,600 being paid into a pension plan.

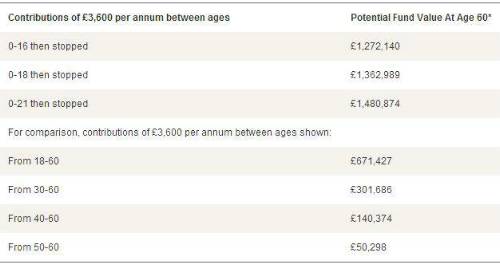

“This provides the opportunity for tax-efficient, long term investments for children by those parents or grandparents who can afford it. Contributions made during the first 18 years of life could be worth more than the equivalent contributions made by that individual during the 42 years from 18 – 60*.

“This table illustrates the potential benefits of starting pension contributions at an early age.

*These projections are based on a medium annual growth rate of 6% net of all charges, and are purely illustrative.

“The earlier the pension is started, the less pressure there is on the child, once they become an adult, to make their own personal pension savings, thus meaning any surplus income can be used to purchase a home, pay down a student loan, or to pay for the general costs of living. Of course, any additional contributions will further increase the potential fund value at age 60.”

Inheritance Tax Benefits

“When the children are young, it is more likely it will be grandparents who are in a position to contribute, since the parents may be paying for their own overheads such as their mortgage, their own retirement funds, and perhaps school fees.

Where the pension contributions are paid by a grandparent, then there may be inheritance tax benefits as well as the immediate tax relief. The reason is that the £2,880 contribution should either fall within the £3,000 annual gift exemption, or else might qualify as normal expenditure from income.

Contributions funded from taxed income rather than from capital will be exempt gifts for inheritance tax if they have been set up with the intention for maintaining them as a regular contribution, and their payment does not adversely affect the donor's standard of living.

“By way of illustrating the benefits, consider the position of a grandparent who pays £240 per month in pension contributions for each of four grandchildren out of their surplus income. These contributions are increased by immediate income tax relief to £300 per month. Five years later the grandparent dies, having reduced their estate by £57,600 in respect of these contributions. The full nil rate inheritance tax band (currently £325,000) is still available, and the grandchildren have £72,000 (before allowing for investment growth) between them in their pension plans. The total tax saving is therefore £23,040 (IHT saving at 40%) plus £14,400 (pension tax relief) which totals £37,440.

“Once the child leaves university, then it may be that the parents would be in a position to take over making these contributions, which by then may provide inheritance tax benefits for them.”

Investment issues

“The potential sums involved in these plans are large, and investment considerations are important. Given the likely period to maturity of the investments made (50 years or more), then a largely equity-based approach may be appropriate. It is vital to seek professional investment advice, and for this advice to be subject to regular review. Initially the pension “pot” would be small, and a stakeholder pension may be entirely suitable. However, once the underlying fund reaches more substantial levels, then it may be advantageous to consider more sophisticated investment solutions, such as self-invested personal pensions for example, to ensure that the correct asset allocation, diversification, rebalancing, and investment management procedures can be accommodated.”

Other investments

Although pensions are arguably the most tax effective way of saving for your children or grandchildren, they do have the potential disadvantage that they cannot be accessed until the child reaches retirement (although some would see this inaccessibility as an advantage).

If you would prefer an investment that the child could access to pay university fees or for the deposit on their first home, then you should consider other methods of saving such as Junior ISAs, investments held in nominee or bare trust, or even investments held in discretionary trusts (particularly if you feel 18 is too young for them to benefit).

Each of these approaches provides different degrees of tax efficiency, access and control for the donor. Which is best for your circumstances will depend on your tax position, when you wish the child to be able to benefit, whether you are using your own ISA allowance, your relationship to the recipient and other factors. A financial planner would be able to explain the benefits and disadvantages of each approach and help you invest in the most appropriate way.

|