By Alex White, Head of ALM Reserach, Redington

To be clear upfront, this is discussing rebalancing between asset classes rather than between individual stocks. As an aside though, eventually all bonds mature or default, and all companies go bust, so the case for rebalancing is that much stronger between individual holdings.

In a Black-Scholes world, this is very easy - you’d rebalance every instant and have a perfectly aligned SAA. In the real world, it’s trickier for a few reasons:

• Transaction costs exist

• Some assets are illiquid

• Some portfolios are very large, and can only trade a limited amount at any given time

• The governance required for frequent trading can be very high

• Assets typically display momentum characteristics over sub-1y periods, so rebalancing more frequently is likely to be detrimental to returns

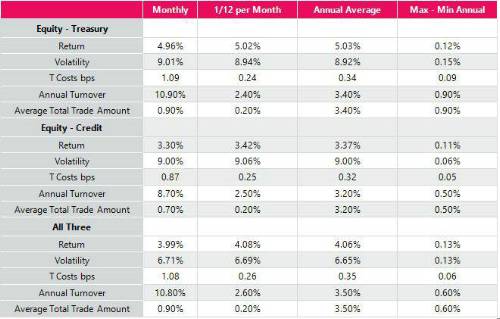

To test this, we considered equity, treasury and credit indices, looking at excess returns in USD (as the US offers the richest data set, with over 40 years’ data). As example portfolios, we consider 60-40 equity-treasury, 60-40 equity-credit, and 40-30-30 equity-treasury-credit. We also ran simulation analysis with similar results. We assume 5bps transaction costs across the board, though these do not meaningfully impact the returns.

Firstly, the differences are not enormous. However, we find annual rebalancing leads to higher returns than monthly rebalancing, because of this trend behaviour. It’s worth allowing a little drift in the portfolio to avoid being structurally short a well-evidenced risk premium.

However, there are two disadvantages to rebalancing annually: There is some sensitivity to choice of rebalancing date and trade sizes are larger

The first point is largely mitigated through time, but over shorter horizons can be painful. At its extreme, rebalancing a 60-40 portfolio in August or February would have made a roughly 6% difference to the portfolio over the GFC. That is an extreme case, and this effect can be favourable or detrimental. This risk effectively diversifies away through time, but it could be very unpleasant in the short-term. Even over the long term, we can see that choice of a lucky or unlucky rebalancing date accounts for around 10-15bps pa of return (and this is exacerbated at longer tenors- for triennial rebalancing this would be nearly 50bps).

The second problem could be harder to navigate, and very large clients may not be able to rebalance annually, or may need to break the trade up and stagger it.

However, there is one other solution. It does require significant governance for no material pickup in returns, so it is only likely to be advantageous to investors with allocations large enough that trade size is a real problem. In this instance, regular partial rebalancing may have a slight advantage.

Rather than rebalancing annually, this structure rebalances 1/12th of the total amount every month (results are very similar for ¼ every quarter). While the returns are very similar to annual rebalancing, the timing risk is mitigated, and the trades are, on average, only 6% as large. For most investors that won’t make a difference, but for multi-billion-pound allocations with significant investment risk it may be a slight improvement.

|