The idea of the product is to get the ‘best of both worlds’, maximising pot growth and flexibility in the earlier phase of retirement, but then switching into the security of a guaranteed income later in retirement, removing the problem of managing an investment pot for an uncertain length of time.

The paper begins by analysing whether drawdown or annuity will give savers the most satisfaction at each stage of their retirement.

The modelling takes account of the fact that ‘downside risk’ may be viewed more negatively than the upside opportunity of investments turning out particularly well.

A key finding of the paper is that for many people there may be an optimum age at which to ‘switch over’ from drawdown to annuity.

This is primarily because getting rid of ‘longevity risk’ through buying an annuity becomes more attractive at older ages.

The exact age at which the switch should take place can vary according to a range of factors, but the paper finds that a switch when someone is in their late seventies or early eighties is likely to work well for most.

The paper points out that although this might be the ideal strategy in theory, in practice people may not make that switch of their own volition. Two important factors are the inertia that would set in after a decade or more of living off a drawdown pot, making switching to an annuity less likely, and the risk of cognitive decline as people become less able to make complex financial choices as they age.

To overcome these barriers, the paper proposes a new financial product – the ‘flex first, fix later’ pension – where the later life switch to an annuity is ‘baked in’ from the start. This would help to overcome the inertia of waiting for people to actively switch into an annuity for themselves, and would mean the product choice could be made when the saver is better able to make that choice and can access more advice and guidance. Annuities could be purchased on a bulk basis by the product provider on behalf of policy holders, thereby potentially delivering a better annuity rate than a saver could secure for themselves as a retail customer.

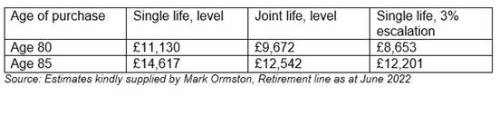

The paper includes estimates of the sort of annuity rates which might be available to those switching in later retirement, and shows that relatively attractive rates could be available depending on the design of the annuity:

There are many ways in which the ‘flex first, fix later’ concept could be shaped, but the basic idea of a later life move to reliance on an annuity is one which is finding favour across pension schemes and providers. The authors propose that this could be a new post-retirement ‘default journey’ for the unadvised mass market of people who had been auto-enrolled into workplace saving and now have to make choices about how to manage their retirement.

Commenting, LCP partner and report co-author Phil Boyle said: “Pension Freedoms have given people the opportunity to go on investing into their retirement, and in many cases this will give them a higher standard of living than buying an annuity as soon as they retire. But annuities are still valuable products, especially as we get older. A ‘flex first, fix later’ product could give savers the best of both worlds – the flexibility and growth potential of drawdown in earlier retirement and the security of an annuity later on”.

LCP partner and co-author Steve Webb said: “A great deal of policy attention has gone in to designing default options for workers when they are building up a pension pot, and there is growing focus on the decisions people make around retirement. But there is currently no default journey for people through a retirement which could last twenty or thirty years. The ‘flex first, fix later’ pension could be a default option which would help people to make the most of their pension savings whilst also giving them the later life security which they need”

LCP Flex First Fix Later paper

|