By Dave Ovenden, Global Lead of Pricing, Product, Claims and Underwriting in Willis Towers Watson’s Insurance Consulting and Technology business.

What is right for your business and where in particular do you strike the balance between people-focused and automated processes?

That’s the challenge underlying intelligent intervention. And while the specifics will obviously vary by company, we believe it involves a common objective – to deploy the right resources to the situation at hand, whether that be full automation without underwriter or claims handler involvement, or a subject matter expert making the call based on insightful decision support.

The importance of data strategy

Any aspirations for achieving that objective will rely on granular data, and a culture that recognises the power of data to both fully automate where it makes sense and provide critical decision support for underwriters and claims experts where it doesn’t.

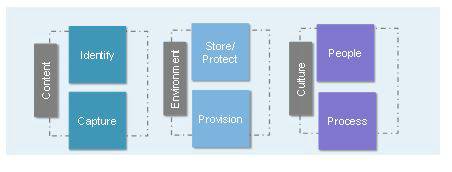

Consequently, a data strategy will need to deliver a single, complete, consistent enterprise-wide source of facts relating to risk and non-risk activities of the business. It will also have to serve functional requirements for reporting, interactive dashboarding and data visualisation to enable frictionless consumption of facts by key stakeholders/systems.

A suitable environment in terms of infrastructure, architecture, culture and tools will allow testing of new data sources and enable analytics and business teams to test hypotheses. Alongside that though, companies will have to ensure roles and responsibilities are clear and that there are internal control, governance and communication structures in place to leverage this resource in pursuit of a single version of the truth.

Figure 1: A data strategy framework for breaking the cycle of poor data

As for the data itself, our view has long been that ‘big data’ starts at home, so a lot of the gains can come from a company’s underlying data assets. That said, there is undoubtably a very large and growing source of invaluable third-party data available, but without a core data asset to connect to, the value is diminished.

Insurers also have huge volumes of unstructured data, which is an area that will continue to offer significant potential competitive advantage. Improving loss cost analytics with claims reports, creating reusable insights from surveys, adapting claims strategies following court or medical reports are all possible.

Automation and AI – a broad church

Moving on to how to apply that data, when companies think today of more automated approaches to underwriting, pricing and claims, either artificial intelligence (AI) or machine learning are often seen as the default solutions.

To some extent, this stems from the overuse of the term AI or the broad use of the term. In fact, AI can encompass a huge breadth of technology, from very deep predictive models through to cognitive learning. Most of the industry spend and investment to date has been at the predictive modelling end and whilst investment will expand through to the cognitive area as the technology matures, there are still very large gains to be made in claims and underwriting analytics using existing methods and approaches.

Deployment challenges

For companies needing motivation to act in this space, the huge range of challenges and uncertainty in the market - geopolitical and technological uncertainty given the pace of change, as well as legal and regulation uncertainty – should be more than sufficient. The aim of pricing, underwriting and claims technology investment should be to create the capabilities to navigate this uncertainty.

Deployment challenges vary across insurers, however it often manifests as lack of pace and agility. Insurers need an environment that enables technology and data to be used at pace to make great decisions at both product and portfolio level and link their technical and business communities. This will help ensure a rich seam of insight running backwards and forwards between internal communities.

Some companies were able to use technology and data to respond quickly to changes in the market. A recent example is the FSA announcements on new and renewal pricing. Leading insurers have been able to resolve their strategy and deploy adjusted rates inside a matter of days. Others have taken months. Equally, companies in the first group could be far more surgical in their approach and achieve better outcomes.

COVID-19 only reinforces these same challenges, but on a very large scale, presenting competitive opportunity for companies that are able to quickly adapt their underwriting rules or perhaps change their automated footprint.

Case study:

A European insurance group asked Willis Towers Watson to carry out an independent review of its complex commercial motor pricing (including complex and commercial) and the underwriting capabilities of all their non-life business units.

From a high-level review of assumptions and models used in the technical pricing, we found very different issues by market (structure, skills, communication, data, technical modelling, customer behaviour, pricing setting, price delivery, and monitoring) and identified some quick wins by country. In addition, we developed per country roadmaps including actions and investment priorities clearly differentiating between recommendations that were specific to a particular country and made sense to be delivered locally, and actions where a centralised approach with Group support would provide synergies.

We then provided recommendations on an optimal setup for the pricing and product teams, including our view of market best practices in terms of engagement with other functions such as marketing, claims, finance and IT. The review has been used as a starting point to set up a unified pricing process within the group.

Business-wide approach

An important point to recognise in intelligent intervention is that, important as it is, the technology itself is not the be all and end all. Intelligent use of automation and analytics is not a siloed activity and still, most certainly, involves people. It raises some high-level challenges that will need the time and attention of the business as a whole.

Firstly, how will new technologies integrate with existing systems? Legacy systems are a fact of life for most (re)insurers and will often represent years of investment. Careful thought needs to be given to how to promote connectivity when implementing automation and decision support, including the benefits of capturing both structured and unstructured data, so that people within the business and customers who need information have it, when they want it.

Also, do we have the people and skills to make automation work for us? Not only will you probably need to tap in to a new and different talent stream, but you may be asking your existing people, such as underwriters and claims handlers, to work in new ways.

Business culture, training, skills and career development, working practices and reward structures will all possibly need reviewing.

Connected specialisms

The point is that automation in (re)insurance, or the use of automation for intelligent intervention at least, needs an inter-connected, business-wide approach, albeit with a technological flavour.

For example, some insurers already recognise that being highly effective at claims estimating opens up opportunities for their portfolio management, underwriting and actuarial teams. Reliable claims estimating provides these functions with a sound basis on which they can confidently make day-to-day business decisions, enabling them to be first movers in a market or agile in changing circumstances, both vital attributes in a highly competitive environment. The digitisation of data assets delivers improved sophistication but also reduces frictional costs.

Asking the right questions

Albert Einstein said, “The measure of intelligence is the ability to change.” It’s no coincidence that, in our experience, companies that do analytics and automation well and with a clear strategy linking pricing, underwriting and claims are best placed to use them to initiate intelligent interventions in their business. The flexibility, agility, speed to market and cost savings that typically come with them naturally deliver benefits from both effectiveness and operational efficiency.

That’s why, when it comes to analytics and automation technology, asking the right questions and addressing the right challenges and issues is critical. Pursuing loss ratio benefits, essentially a measure of effectiveness, will deliver efficiency savings too.

|