By Simon Taylor, Partner and Head of Employer DB Consulting at Barnett Waddingham

Many sponsors and trustees had a vague ambition to reach buyout, but it was a long way off and reaching that goal within a reasonable timeframe would typically mean significant cash injections from the sponsor.

Trustees wanted to buyout for member security and sponsors wanted to get the scheme off their balance sheet because they were fed up with the increasing costs and risk. Using DB Navigator, we helped our clients to determine a realistic, achievable journey to reach the endgame (in most cases buyout) by considering the cost and risk constraints of the sponsor and the requirements of all stakeholders.

And then 2022 happened…

Current challenges

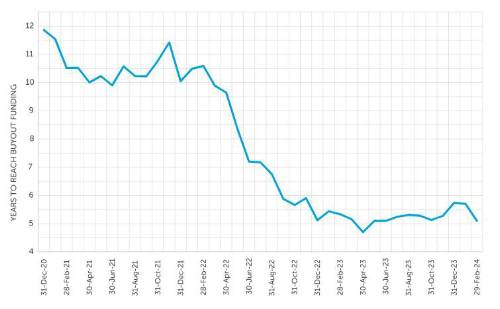

After some very painful turbulence for some schemes, most are now in a much better funding position and significantly closer to being able to buyout. The chart below shows how our DB End Gauge index (which measures the average time to reach buyout funding for the schemes of the FTSE 350 companies) has changed over the last three years.

Sponsors and trustees are closer to their target and it’s now looking more affordable. So, that’s all positive then? Well, yes, it is - but the market changes which have driven this positive development have also been accompanied by the backdrop of a shifting regulatory and economic landscape.

We’ve seen the first two consolidator transactions. There is currently a consultation from DWP (Department for Work and Pensions) around options for DB schemes, covering the treatment of scheme surpluses and using the PPF (Pension Protection Fund) as a consolidator.

Following the Mansion House compact calling for pension schemes to invest in productive UK finance, the Chancellor announced measures to work towards this in the Spring budget 2024. Several providers have entered the market looking to offer innovative capital backed products to pension schemes, guaranteeing returns or target funding levels. We’ve seen IBM re-open its DB scheme (on a cash balance basis) in the US, using the surplus in it to cover the cost of new accrual. Some UK employers are using the surpluses in their DB schemes to fund their DC (defined contribution) contributions, introducing (or in some cases reintroducing) a DC section in their DB trust.

Alongside this, there are concerns about insurer capacity for bulk annuity transactions (despite potential new entrants sitting in the wings) and mutterings about the amount of UK annuity business being reinsured in offshore, less transparent, territories.

Now is the time to act

So, what does this all mean?

"Given the seismic shifts over the last few years and the anticipation of future changes, now is an excellent time for scheme sponsors to take a step back and reassess their pension scheme strategy as a point of good governance."

Simon Taylor, Head of Employer DB Consulting

There have been changes (positive and negative) on both sides of the buyout versus run-off argument and increasing confidence in alternative solutions. In relation to the sponsor’s day job, borrowing costs seem to have stabilised after the sharp rises in 2022, the outlook for inflation looks more benign and the impacts of Covid-19 and Brexit on supply chains and customer bases are now clearer (for better or worse). Admittedly there is still some uncertainty in the system with upcoming UK and US elections and ongoing conflict in Ukraine and Gaza, but markets have been pretty resilient so far to these events.

Steps to re-evaluate your DB strategy

The good news is that our DB Navigator still provides the framework to help sponsors get answers to the right questions in order to reassess their strategy in light of evolving circumstances, to see whether a change in direction is warranted or whether to continue on the course already set.

The first stage for the sponsor is to take a fresh look at its cost and risk budgets. Both of these could be very different now given the general improvement in scheme funding levels and asset de-risking.

Alongside this, the sponsor should identify appropriate financial measures that will enable it to differentiate between the various scheme strategies – buyout, run-off, or alternative solution – and also to compare against alternative (non-pension) uses of cost and risk within the business. Some sponsors will be focused on a cash metric, others may look at income statement or balance sheet metrics and some may be interested in cost of capital type measures. Sponsors may focus on a combination of these.

Alongside these quantitative measures, sponsors should also overlay qualitative measures such as the impact on internal management time and focus and the outcomes for members (for example, discretionary pension increases).

Once these parameters have been set, the next stage is to compare each potential strategy against them. This will involve detailed modelling of the costs (contributions and running expenses – both external and internal) and risks involved in each, including how these will impact on the identified measures.

Key areas of increased investigation

Given recent developments, there are likely to be some areas that are investigated more closely than previously, such as:

The viability of the bulk annuity market: we have seen some new entrants which should be a welcome development, especially if these focus on areas of the market that are currently less well served (such as the smaller end of the scheme size). Conversely, there is some concern around the amount of bulk annuity business that is being reinsured offshore and the ongoing viability of some reinsurers.

Ongoing regulatory risk: sponsors will be all too aware that pension legislation has largely been one-way traffic against them. Pensions have always been a political football and sponsors have seen successive governments pile more obligations on them over the last three decades. Sponsors have underwritten all the risks of the scheme and pumped huge amounts of money into them that, arguably, could have been better spent elsewhere in the business.

So, it is welcome news for sponsors that the government’s stated intention is to make surplus extraction easier, but this is not enshrined in legislation yet and, in any event, the scheme’s trustees will sit between the sponsor and any surplus. However, the sponsor can use any surplus it can access to, for example, fund some or all its DC contributions or towards pay increases for current employees.

Running the scheme off will expose the sponsor to regulatory risk – for example, if there were to be a period of sustained high inflation, could a government, coming under pressure from an electorate and with schemes running-off and generating surpluses, amend the legislation to increase the statutory LPI cap for future pension increases? Sponsors have long memories and their appetite for regulatory risk will be a key driver of any decision on future strategy.

Sponsors who do want to run off their schemes will want to ensure that the process is less time-consuming and costly compared to now. Cost control agreements and protocols for surplus sharing will be required to reduce management time and effort.

Alternative solutions: consolidators are now a real possibility with a nascent track record. Capital backed products are coming to the market and are already being assessed by sponsors and trustees. There may well be a viable ‘third way’ that didn’t really exist when the strategy was initially discussed. Capital backed solutions may also feed into the strategy to reach buyout or to generate surplus when running on the scheme. We are seeing real game changers here which need to be factored onto decision making.

|