By Tara Kneafsey, SME Director at RSA

SMEs are the backbone of the British economy, accounting for more than 99 per cent of UK enterprises, employing over 20 million people and generating an estimated annual turnover of £3,200 billion. Their success is inextricably linked to the nation’s economic recovery and the sector has rightly been placed at the forefront of the Government’s strategy for fueling growth. Yet continued economic difficulties, the burden of increased regulation and business disruption are having a tangible impact on the fortunes of the nation’s SMEs.

Undoubtedly, SMEs have had it tough. Over the past two years they have experienced sharp rises in fuel, energy and materials costs; culminating in annual inflation hitting a staggering 6.9 per cent by September 2011 . While many commentators have made doomsday suppositions about the effects of the current economy on SMEs, little has been done to truly understand the exact nature of the difficulties faced by them and the potential opportunities.

In conjunction with Warwick Business School, we have examined the current profile of risks and new opportunities faced by SMEs in four important UK sectors – retail, business services, road freight and manufacturing, all considered potential bellwethers of the wider business landscape – and published the findings in our Risky Business Report.

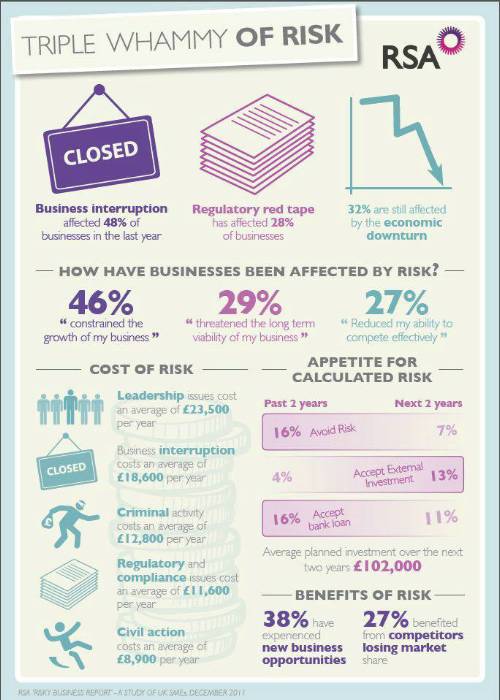

The findings reveal that a quarter of SMEs believe the economy has threatened the viability of their businesses, and around half of all firms say they have found growth considerably restrained. These difficulties have also been exacerbated by other factors, with a significant proportion of SMEs facing non-commercial risks due to crime, extreme weather, regulatory changes and staffing problems.

Risky Business Report key findings:

• One in three SMEs are still significantly impacted by the recession – yet over a quarter have benefited from others losing market share.

• Nearly half of respondents (48 per cent) have experienced business interruption in the past two years at an average cost of £18,600 per year. Severe weather and extra bank holidays are the two incidences said to have proved most costly.

• A quarter of firms (25 per cent) have been affected by criminal activity in the past two years, at an average cost of £12,800 per year.

• Leadership issues have affected more than one in 10 firms (14 per cent), with an average annual cost of £23,500.

• More than one in four firms (28 per cent) have experienced regulatory and compliance issues, costing an average of £11,600 every year. Health and safety compliance remains the biggest burden to SMEs, despite Government promises.

• Civil action affected more than half of respondents (54 per cent), costing an average of £8,900 annually.

Despite the pressures, industrious SMEs have demonstrated a growing appetite for taking calculated risks in order to boost growth, with those reporting to be risk-averse reducing by over half for the next two years of trading (16 per cent in the previous two years compared to seven per cent over the next two years).

A ‘Dragon’s Den’ mentality also seems to have emerged, with the number of firms looking to accept external investment increasing from four per cent in the past two years to 13 per cent in the coming two years. This seems to be at the expense of the banks, with interest in taking out a bank loan decreasing by eight per cent over the same period.

Encouragingly, planned business investment for the next two years among SME stands at an average of £102,000. Looking at the four sectors interviewed, it is Manufacturers who plan to invest the most, with an average projected spend of £140,800.

It’s clear that, for some, new opportunities have been borne out of the challenging economic climate. As many as two fifths (38 per cent) of firms say they have experienced new opportunities over the past year as a result of risks relating to the economy and business interruption, while more than a quarter (27 per cent) say they have benefited from others losing market share.

In reality though, the economy is just one problem that small businesses face post-recession; we must remember that crime, extreme weather, regulatory changes and staffing problems all also represent critical business risks. Despite these issues, innovation remains and there is real determination among the SME community to survive and flourish, and the importance of economic growth driven by SMEs in the coming years should not be underestimated.

|