Dean Butler, Managing Director for Retail at Standard Life, part of Phoenix Group said: “The latest inflation figures show a nation still dazed by rapidly spiralling prices. The toll on households trying to pay their bills each month is mounting, but those lucky enough to have cash-based savings are starting to see a real dent in the value of their hard-earned accounts. Interest rates have risen fast over the last 12 months, but with most best buy instant access rates currently sitting below 4% they’re still nowhere near a match for inflation, which remains at 8.7%. With inflation forecast to fall to around 5% by the end of 2023, savers face a race against the clock to break even.”

The impact of inflation on cash-based savings

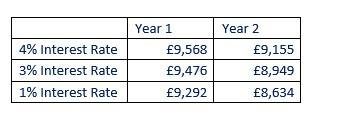

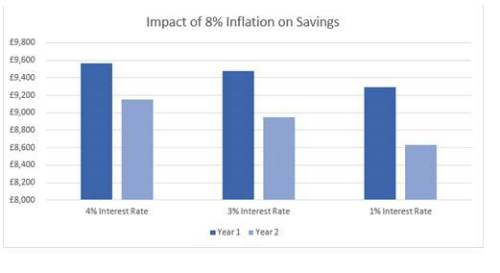

“Our analysis shows that even with an interest rate of 4%, savings of £10,000 will be reduced to around £9,155 after two years if inflation remains at 8%. At 3%, savings will reduce to £8,949 in real terms over the same period. Some savers are still only earning around 1%, often if they’ve not upgraded their accounts since the Bank of England started raising rates – their savings will reduce all the way down to £8,634. These figures highlight the importance of ensuring your savings are working as hard as possible for you.

“As interest rates continue to rise, millions of households face huge increases in their mortgage payments over the coming months, countering any savings gain. For those able to take a longer-term view, putting cash into investments via an ISA or pension provides the potential for returns that can match - or even beat - current rates of inflation as well as offering additional tax efficient benefits.”

£10,000 in an easy access cash-based saving account

|