In the November 2014 EIOPA insurance stress tests, the stress scenarios in the Core Module demonstrated the vulnerability of the insurer sample to reversals of market values and a downward shock to interest rates. EIOPA believe such market reversal scenarios to be a key risk for the insurance sector. Exposure to these risks is a function of an institution’s approach to Asset-Liability Management (ALM) and the choices made in relation to balance sheet structure. EIOPA has recommended that national competent authorities engage with insurers to ensure that they have a clear understanding of their risk exposures and the vulnerability to given stress scenarios.

Negative investment returns (which can be further compounded by resultant excess lapses) represent a serious threat to an insurer’s ability to meet its solvency capital requirements (SCR).

Previous articles by FRS described how an underfunding unit-linked matching policy (based on items proportional to unit values) would release cash, minimise volatility of Solvency II funds and reduce market SCR. Factoring in how this can help protect against lapse risk further strengthens the case for underfunding, as outlined in this article.

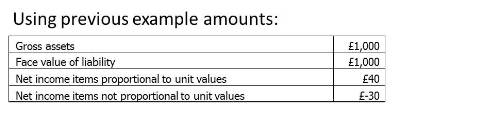

Using previous example amounts:

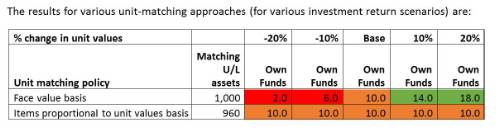

It can be seen that the underfunding approach protects against the downside risk from movements in asset values whilst foregoing the upside (as the own funds figure remains constant at 10) whereas the conventional face value basis exposes the insurer to volatility in the own funds figure and could create red light exposures.

Some reservations have been expressed by insurers about the underfunding approach in the context of lapse risk because excess lapses result in reduction in own funds. However this article explains firstly why investment risk is the most important risk to address and secondly how lapse risk can be dealt with. It is imperative to use the underfunding approach to maintain own funds in the dual adverse scenario of negative investment returns and excess lapses.

Consider the results from the above table for the face value basis.

A 10% fall in investment values would reduce own funds from 10 to 6 (because of a fall of 4 in the proportional net income items). Excess lapses would need to be 40% to produce the equivalent fall in own funds. A 10% fall in investment values is much more likely than 40% excess lapses and so it is the investment risk that is most important to mitigate. Worse still is that a fall in investment values is the factor most likely to result in excess lapses. So it is necessary to protect against the combined threat of the really dangerous scenario for the life insurer of negative investment return followed by excess lapses.

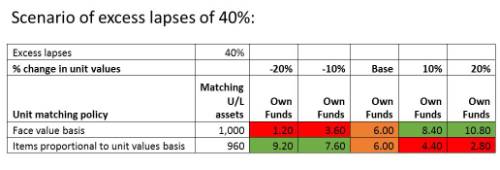

Here it can be seen that the face value approach deals very poorly with the combined threat with own funds falling to 3.6% for the scenario of -10% investment return followed by 40% excess lapses. The reason is that -10% investment return reduces own funds from 10 to 6 because (because of a fall of 4 in the proportional net income items) and the subsequent 40% excess lapses reduces this further to 0.6*6=3.6. The -20% investment return scenario reduces own funds from 10 to 2 and the 40% excess lapses reduces this further to 0.6*2=1.2.

A further adverse feature is that even these significant reductions in own funds figures are predicated on the assumption that the -30 items reduce proportionately on the excess lapses (if they remain unchanged, the own funds figures would reduce by 12 on the 40% excess lapses). Such excess lapses would probably require some increases in the per-policy expense provisions, further emphasising the need to avoid unnecessary reductions in own funds from negative investment return scenarios.

The underfunding approach provides much better protection because underfunding in the context of excess lapses is beneficial when investment returns are negative. So the -10% investment return would leave own funds unchanged at 10 (because of perfect matching) and the subsequent 40% excess lapses would reduce future margins by 0.4*(0.9*40-30) =2.4 giving residual own funds of 7.6. The -20% investment return scenario would reduce future margins by 0.4*(0.8*40-30) =0.8 giving residual own funds of 9.2.

On the flip side, the danger with underfunding lies with positive investment returns followed by excess lapses (because there is an investment loss on the excess lapses) – the red light positions of 4.4 and 2.8 in the above table. Although it is possible, for example in the event of regulatory change, it is a less-likely scenario. It is also a much less dangerous scenario generally for insurers (because the scenario of positive investment returns is generally favourable from own funds or solvency perspective) e.g. the negative effect on unit-linked business is likely to be offset by positive items on other parts of the insurer’s business (e.g. increases in values of other shareholder assets or non-linked assets).

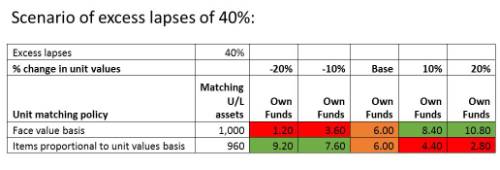

In the +10% investment return scenario followed by the 40% excess lapses, this would reduce own funds to 4.4 but as the following table shows that could be increased by simply applying the underfunding based on a specified proportion of the net income items (e.g. if we want to make provision for 20% excess lapses, then the underfunding is based on 80% of the 40) whilst giving up some of the downside protection.

The results are shown below illustrating how the life company can protect against the scenario of positive investment returns followed by excess lapses.

In deciding the level of underfunding, there is no one correct answer – it all depends on how much latitude the insurer has in respect of availability of own funds and what risks the insurer wants to protect against.

The conclusion is that underfunding in conjunction with provision for excess lapses protects in a much better way than the face value approach against investment losses without creating an own funds exposure on excess lapses where markets rise.

The capital benefits (release of cash, minimising volatility of Solvency II funds and reducing market risk SCR) from underfunding can be achieved whilst protecting against investment losses on excess lapses (where markets rise).

In summary, for life insurers with large unit-linked portfolios, underfunding of Solvency II unit liabilities will be a critical part of an efficient capital management programme to protect against market reversals and excess lapses. However it is crucial that the functionality and reporting capabilities of their fund administration system - for validation purposes and cross-reporting to the actuarial function – provide the ability to accurately manage the unit-linked matching process and ensure a successful and compliant capital management programme.

|