By Alex White, Head of ALM Research, Redington

There are a number of reasons why a scheme’s LDI portfolio can fail to match the liabilities it is designed to hedge. Not managing them carefully can result in funding level deviation of as much as 5%.

What are some of the sources of hedge inaccuracy?

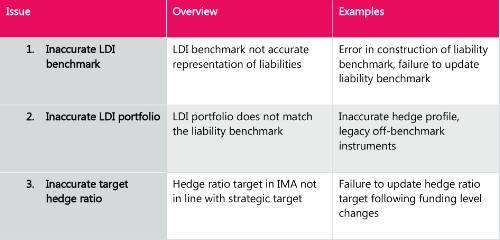

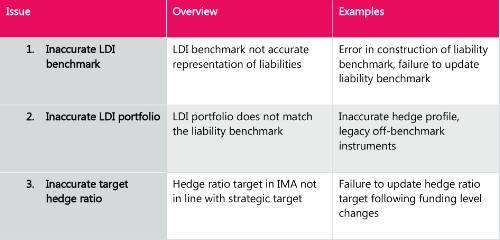

Hedge discrepancies can arise from a wide range of reasons. The high-level categories are below:

These examples represent just a selection of potential issues. In practice, discrepancies can arise from a much wider range of reasons, and the list here is by no means exhaustive.

How to estimate the impact of hedge inaccuracies?

Start with a standard UK Defined Benefit (DB) pension scheme that was 80% funded with £1bn of liabilities (on a gilts flat basis) as at 31 December 2010. Its asset allocation is 60% equities and 40% LDI, the latter of which is used to back a hedge up to the funding ratio (i.e. 80% of the liabilities).

Next, project forward the scheme’s funding level on a quarterly basis until 31 December 2018 assuming an “ideal” LDI hedge that does not suffer from any of the hedge inaccuracies listed above.

Repeat the analysis above 7 times, each with a different source of error in the hedge.

Finally, compare the funding ratios for each quarter for the “ideal” and each of the “inaccurate” series, reporting the maximum deviation in funding level and deficit.

How much of an impact does hedge inaccuracy have on funding level and deficit?

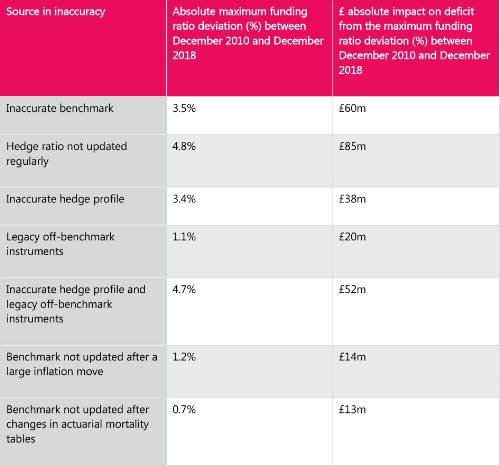

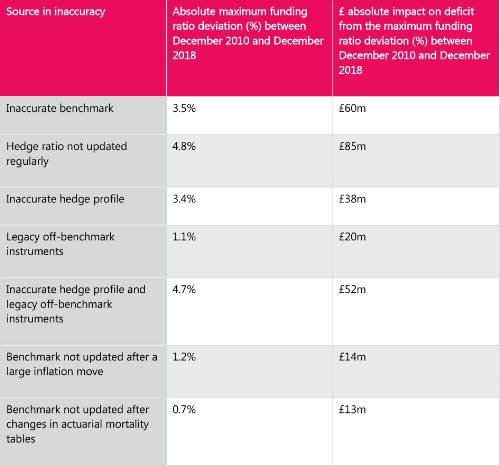

The table below sets out the results of our analysis, showing the deviation (in funding level and deficit terms) between the “ideal” hedge and the different “inaccurate” versions:

Hedging to the funding ratio is a significant mitigator of a number of these inaccuracies. If liabilities are overstated to 110%, funding level will be understated by 1/110% and the product of the two (amount to be hedged) will remain unchanged. If hedging to an absolute level, over- or understating of the liabilities will result in an inaccurate amount of hedge put on and these values would be meaningfully higher. This is one advantage of hedging to the funding level as a strategic choice.

Conclusion

The liability cash flows themselves are estimated based on actuarial assumptions, it makes sense to make the best possible use of the available information and hedge interest rate and inflation risks to those liabilities accurately if minimising unnecessary risk is a priority. This is because, as the analysis reveals, the way the LDI solution is implemented has a material impact on the funding ratio of the scheme. Attention should be paid particularly by pension schemes with very limited risk budget and low appetite for volatility.

From experience, LDI portfolio “health checks” can help uncover current sources of inaccuracy. These can also be used as an opportunity to put the right governance structure in place for monitoring and making sure that the hedge remains accurate in the future.

|