By Fiona Tait, Technical Director, Intelligent Pensions

Where it fits Where it fits

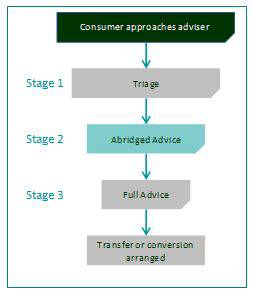

Let’s start by stating that abridged advice is advice. It is not guidance and is therefore clearly distinguished from triage, which under the updated regulations has been put firmly back in the guidance box.

There are 2 practical consequences:

1. A member seeking to transfer their safeguarded benefits may well have to go through 2 stages before they receive a personal recommendation.

2. Unless they do progress to abridged advice the responsibility for any action taken lies with the member.

It is not necessary for advisers to offer a triage service however most agree that it is beneficial. It is a low-cost service and requires very little effort from the adviser to deliver. What it doesn’t do is provide any protection for the member if things go wrong.

The next key point is that abridged advice is abridged. It is not full advice. This mean that the client will be afforded the protection of regulated advice however the advice is not based on the full story.

The FCA have stipulated what can and cannot be included in abridged advice and, in simple terms, it covers the first 3 stages of the full advice process:

1. Finding out about the member and their individual priorities (fact-finding)

2. Finding out about the scheme (information gathering)

3. Assessing the member’s attitude to risk

This tells the adviser why a transfer is being considered, if the member can achieve their objectives without transferring and if they should even be considering giving up a lifetime income guarantee. It does not, and must not under the rules, consider how the member’s objectives could be achieved under an individual pension arrangement. Therefore, those who do proceed to full advice will receive the obviously additional benefit of an in-depth comparison between their scheme and a suitable replacement, including any workplace pension arrangements. Full advice is also likely to include cashflow planning, which is not specifically prohibited from abridged advice but must be limited to scenarios based on benefits remaining in the scheme.

So, in theory at least, abridged advice does around half of the job and full advice completes the process.

Will it be a success?

It certainly has the potential to be, but as an entirely new service the results will probably only be known once it has been tried out.

Key factors include:

• Cost – the FCA believe abridged advice should be a low cost or even free service. Certainly, there is less work to be done however a significant proportion of the full advice process is still required, and much will depend on whether advisers can deliver their recommendations without the extensive to-and-froing to obtain scheme information. In theory, without the need to carry out a Transfer Value Comparison all the required information should be available in the member’s statements and scheme information booklets, in practice this is may not always be the case.

• Member demand – uncertainties arising as a result of COVID may put members off self-managed solutions; alternatively, loss of earnings and employment could lead more people to consider accessing their pension fund earlier with the option to turn income on and off.

• The quality of the advice – abridged advice may only be delivered by qualified Pension Transfer Specialists however this has not always provided sufficient member protection in the past. It is essential that advice firms do not seek to game the system and deliver a fairly priced service.

• The results – abridged advice will have served its purpose if fewer members go on to seek full advice, however if a significant majority are recommended to proceed then it will merely serve as a further delay in an already lengthy process. Equally if a significant proportion of those who do go on take full advice are recommended not to proceed there may well be a member backlash.

I personally believe abridged advice has a useful part to play. There are identifiable factors which make it highly unlikely that a transfer will be suitable, but it probably takes a professional adviser to easily spot them and this will also ensure consumers have some protection if the recommendation was clearly unsuitable. Success will however depend very much on what advice firms make of it and whether it makes a difference to members’ decision-making.

|